do nonprofits pay taxes on rental income

This topic doesnt address taxes that are related to business or rental property. In other words it may not be appropriate to treat a rental activity as a business if a landlord does not file all required Forms 1099-NEC.

CLTs are nonprofits that own land - received as donations or bought with government subsidies - to ensure it stays affordable for long periods.

. So now we know. This is something the IRS has never said before. If its for housing the homes are sold to lower-income families but the land is still owned by the CLT.

Your gain or loss for tax purposes is determined by subtracting your propertys adjusted basis on the date of sale from the sales price you receive plus sales expenses such as real estate. If you lose money youll be able to deduct the loss subject to important limitations. It does not discuss income requirements for tenants of qualified residential rental projects the rules governing the qualified project period or other guidance applicable to qualified residential rental projects.

The land is used for housing or other community purposes. The first Emergency Rental Assistance ERA1 program set aside 25 billion on December 27 2020 through the Consolidated Appropriations Act. Failure to do so is a mark against you if the IRS ever questions whether your rental activity is a business.

For information regarding business. This interview will help you determine if personal taxes you paid are deductible as an itemized deduction on Schedule A. Landlords should be filing 1099s.

When you sell rental property youll have to pay tax on any gain profit you earn realize in tax lingo. To protect Americans from the loss of basic housing security due to the devastating impact of COVID-19 two emergency funding programs have been assisting households unable to pay rent or utilities. It discusses the residential rental property requirements of IRC Section 142d including what types of property can be financed and the qualified uses of that property.

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Multi Step Income Statement Template Elegant 6 Multi Step In E Statement Statement Template Income Statement Templates

Every Nonprofit S Tax Guide How To Keep Your Tax Exempt St Tax Guide Non Profit Irs

Pin By Jason Ritter On Quick Saves Internal Revenue Service Tax Forms Fillable Forms

Explore Our Image Of In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Know These Costs Before You Start Your Nonprofit In 2021 Non Profit Startup Funding Grant Writing

Pdf Taxation Of Non Profit Associations In An International Comparison

Browse Our Example Of Non Profit Start Up Budget Template Budget Template Spreadsheet Template Budgeting

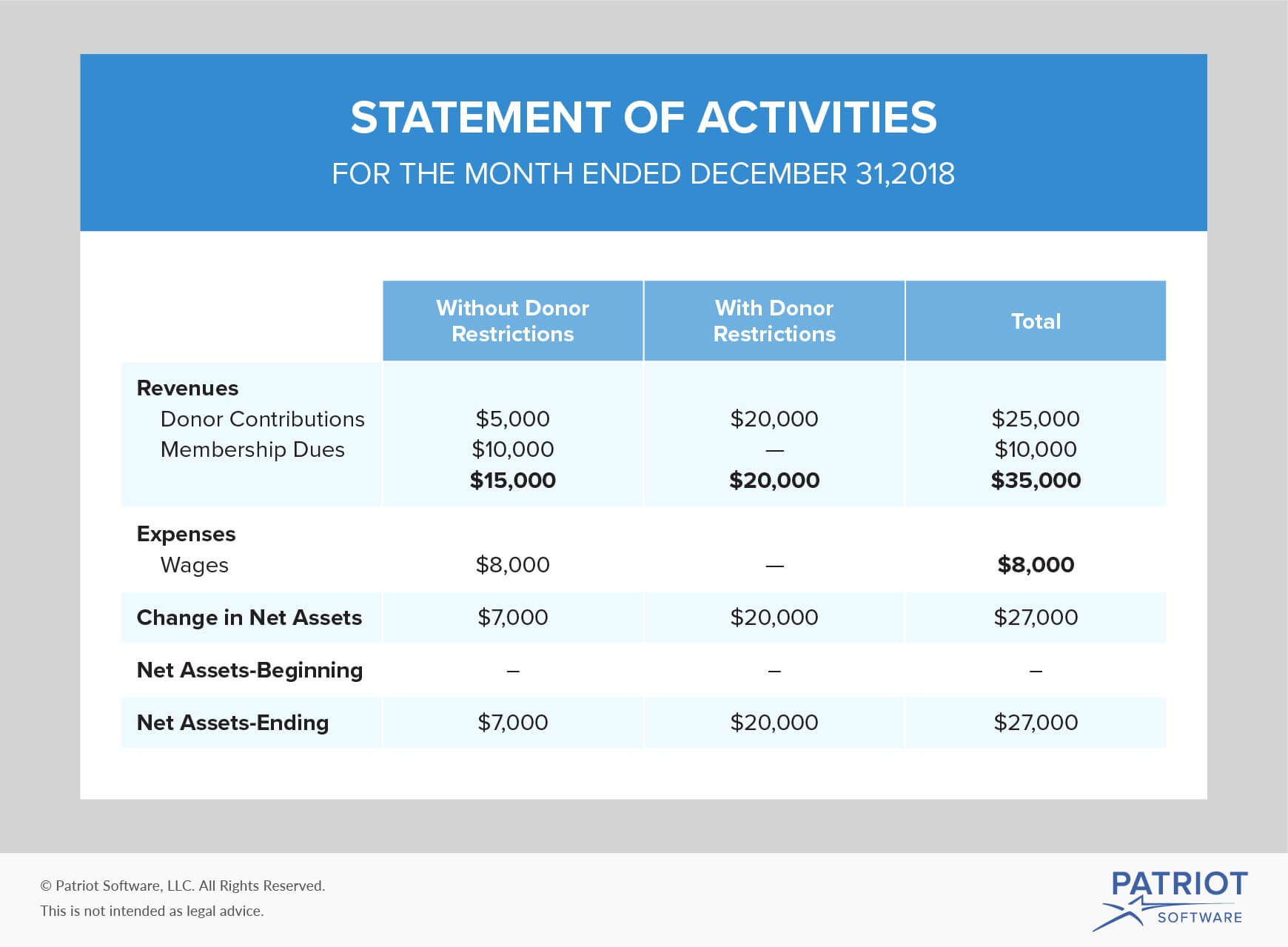

Accounting For Nonprofit Organizations Financial Statements Beyond

Pin By Letter Writing Tips On Fundraising Letters Business Letter Sample Fundraising Letter Guided Writing

2020 Guidelines For A Nonprofit Reimbursement Policy

Super Forms 1099 Misc Forms Preprinted Set 4 Part Miscs405 Irs Tax Forms Tax Forms Irs Taxes

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Table To Convert Entrepreneur Income To Day Job Income Job Entrepreneur Income

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)